Excitement About How To Start Trading Forex

Wiki Article

The Ultimate Guide To How To Start Trading Forex

Table of ContentsThe Ultimate Guide To How To Start Trading ForexExcitement About How To Start Trading Forex4 Easy Facts About How To Start Trading Forex DescribedExamine This Report on How To Start Trading ForexGetting The How To Start Trading Forex To WorkHow To Start Trading Forex - Truths

:max_bytes(150000):strip_icc()/GettyImages-483658563-5756fd9e5f9b5892e8e0da65.jpg)

Not every capitalist is approved for a margin account, which is what you need to utilize in the stock exchange. Forex trading is very various. To qualify to trade with utilize, you open up a forex trading account. There are no qualifying demands. The exact leverage limitation depends upon the broker agent, however numerous investors can expect to accessibility as high as 50:1 leverage.

The How To Start Trading Forex Statements

For some, the restrictions enforced by guidelines may press them toward forex trading. Others see guideline as an additional layer of protection against scams and misbehavior, so they might like to trade in that atmosphere.Trading on the forex market is a different world. All major globe money are very liquid, which means the 2 markets have extremely various rate sensitivity to profession activity.

In sharp comparison, foreign exchange trades of several hundred million bucks in a major currency will more than likely have littleor noimpact on the money's market value. There is also much supply for any single deal to have way too much of an impact. In money trading, currencies are always priced estimate in sets (how to start trading forex).

What Does How To Start Trading Forex Do?

The only "set" is between the supply rate and the U.S.Forex markets foreign exchange exhibit often show higher emerging political and economic situations financial other countriesVarious other Currency markets have higher gain access to than stock markets. Investors can trade supplies almost 24 hrs a day from Monday via Friday, yet it isn't especially very easy to access all those of markets.

The Ultimate Guide To How To Start Trading Forex

brokerage with one significant trading period from 9:30 a. m. to 4:00 p. m. EST. There is a much smaller "after-hours" trading market, yet those hrs usually have less liquidity and also various other issues that make them much less prominent than normal trading hours. Foreign exchange trading, on the various other hand, is much less complicated to do all the time, Monday through Friday.Choosing which market to profession is greatly an individual choice. A beginning forex investor has numerous of the tools available to them that a seasoned trader has, whereas a supply trader needs to obtain special qualifications and also conserve up a substantial quantity of capital to trade like the pros.

Supply trading can be less complicated to cover your head around. While more comprehensive financial context always assists, buying a supply is a basic conceptyou're buying a share of ownership in a firm. That, along with the highly regulated setting, can place some investors comfortable and also assist them concentrate on their trading method.

All About How To Start Trading Forex

When a securities market declines, you can generate income by shorting, yet that imposes extra threats. In foreign exchange trading, you can go short on a money pair as conveniently as you can go long. Both placements existing comparable risks. No added preventive trades to restrict losses are essential. One threat of shorting a supply, at the very least in theory, is that you may have limitless losses.Nevertheless, most financial advisors caution versus shorting for all, and much of the most experienced financiers perform parallel stop-loss and also limitation orders to include this risk. The majority of financiers are a check these guys out lot more knowledgeable about the stock market than with forex, which familiarity may be comforting. Others will choose the greater threat/ incentive ratio that includes the uncontrolled forex atmosphere as well as its high degrees of utilize.

Forex trading is generally less controlled than stock trading, Related Site and foreign exchange traders have access to a lot more utilize than supply traders. Foreign exchange trading uses pairs, so the profession relies on the performance of 2 economic situations instead of trading a solitary stock. Currencies are much more fluid than stocks, they trade whatsoever hours of the day, as well as huge orders have less influence on money pairings than they do on supply rates.

Examine This Report about How To Start Trading Forex

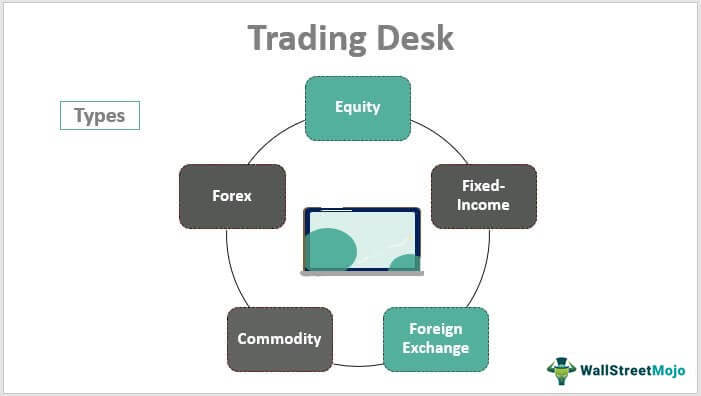

Foreign Exchange (FX) is a portmanteau of words international [money] as well as exchange. Fx is the process of changing one money right into one more for various reasons, normally for business, trading, or tourist. According to a 2022 triennial report from the Bank for International Settlements (an international bank for nationwide reserve banks), the everyday worldwide volume for foreign exchange trading reached $7.Keep reading to find out about the foreign exchange markets, what they're made use of for, and also just how to start trading. The forex (forex or FX) market is a worldwide industry for exchanging nationwide official statement money. As a result of the around the world reach of trade, business, and financing, forex markets tend to be the world's biggest as well as most fluid property markets.

Report this wiki page